Pay Advance: When You Need Your Pay Early

The Modern Way To Access Your Pay

A pay advance is not a new service, but it has changed significantly with recent developments in technology. What used to be a once-off benefit provided by some trusting employers has evolved into an innovative industry of its own. This industry is where modern businesses like Wagepay have grown in leaps and bounds, and we are here to revolutionise the way you access your pay.

So, what Is A Pay Advance? A pay advance, also known as a payday advance, is a service employed people can use to request a portion of their upcoming paycheck before pay day. Traditionally offered directly from employers, pay advances can now be confidentiality accessed online through companies like Wagepay without the requirement to involve your employer directly.

What Are The Advantages Of Pay Advances?

There are plenty of reasons people choose a payday advance when they need a short-term cash boost:

- They can be accessed online or through mobile apps, making it easy for people to get the money they need when they need it.

- They are a convenient way to access money quickly without ]going through a lengthy personal loan application process.

- They generally don’t require a credit check, which can be appealing to people who don’t want their credit history impacted.

- They can offer more flexibility than traditional loans, as you can advance smaller amounts of money and repay it on your next pay day, instead of committing to years of repayments.

What Makes A Wagepay Pay Advance Different?

Wagepay’s service not only has all the standard benefits of a payadvance product but also offers many other advantages over the competition:

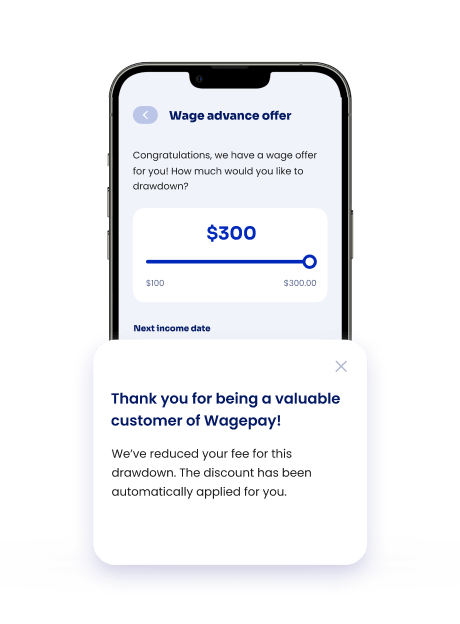

- We are one of the only pay advance providers to offer tiered pricing, meaning our service is even cheaper for our loyal customers.

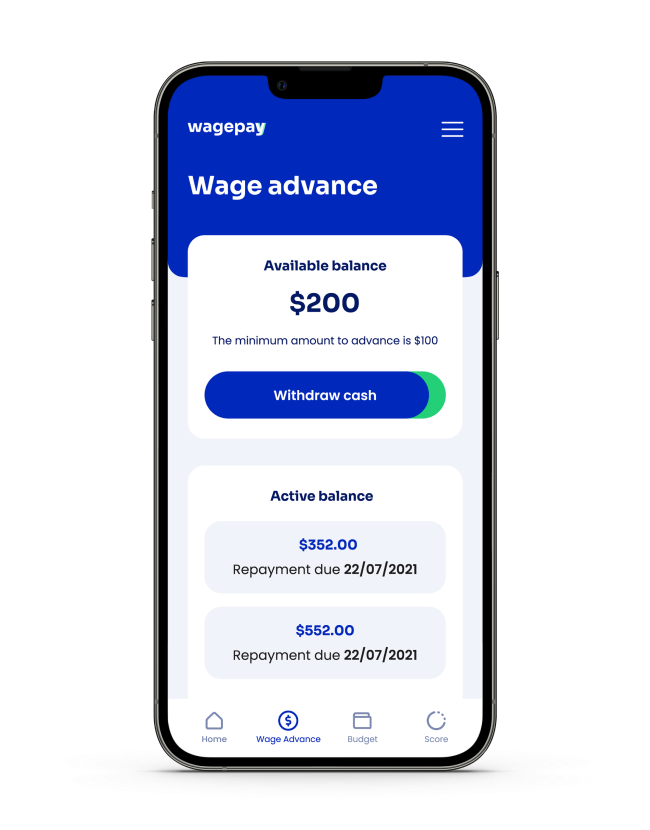

- When you create an account, you will be provided with an “advance limit” of how much you can advance. You can then just draw down how much you need, to a minimum of $100, when you need it.

- We are one of the first businesses in Australia to offer real-time direct debits, also known as PayTo. With PayTo, repayments will be reflected on your account in real-time, instead of multiple business days like traditional direct debits.

Who Can Use Wagepays Pay Advance App?

If you want to use Wagepay’s pay advance app in Australia, you have to satisfy the following minimum requirements first:

- You need to be 18 years or older.

- You need to live and work in Australia.

- You need to have a secure job that pays you at least $500 weekly.

- You must have enough funds in your account after each pay period to repay your advance.

- You need to maintain good banking conduct in your bank account.